What is Marine Insurance?

A simple definition of insurance would be “Protection against future loss.” Marine insurance is another variant of the general term ‘insurance’ and, as the name suggests, is provided to ships, shipyards, marinas, offshore installations and floating equipment.

Independent owners can avail insurance facilities for their watercraft (PWC), megayachts, yachts, and pleasure craft. Some boat insurance coverages include wreck removal and salvage without additional hull coverage costs.

Most importantly, cargo insurance provides coverage to cargo loaded onto ships or vessels during the transportation process.

Different types of coverage options offer protection to various kinds and sizes of ships, depending on routes taken. Insurance policies are well-laid-out contracts that need to be abided by both parties. A policy ensures the vessel is against common risks of property damage, theft, collision, explosion, capsizing, etc.

Marine Liability Insurance/P&I, or protection and indemnity, protects third party liabilities that shipowners and companies are exposed to during their operations. It is indemnity and not liability coverage. It includes coverage for injuries, illnesses, and loss of life caused by operating the vessel. Medical expenditures, damage to other vessels, collision and related expenses are also covered.

Many types of insurance and marine insurance companies with years of experience and expertise offer different coverage plans. Some inland marine insurance providers provide coverage to goods in transit, even when they have reached land and are taken to storage and logistics facilities.

Marine insurance coverage is essential because, through marine insurance, ship owners and transporters can be sure of claiming damages, especially considering the mode of transportation used.

Of the four modes of transport – road, rail, air and water – it is the latter most which cause a lot of worry to the transporters not only because there are natural occurrences which have the potential to harm the cargo and the vessel but also other incidents and attributes which could cause a huge loss in the financial casket of the transporter and the shipping corporation.

Incidents like piracy and possibilities like cross-border shoot-outs also pose a major threat to water shipments. Therefore to avoid any loss because of such events and happenings, in the interest of the corporation and the transporter, it is always beneficial to have a backup like marine insurance.

Another important aspect of having marine insurance is that a transporter can choose the insurance plan as per the size of his ship, the routes that his boat takes to transport the cargo and many such minor points which could go a great length in affecting the transporter majorly.

Also, since there are various plans and policies which indicate covering not just the cargo but also the vessel, the transporter can choose and avail of the best policy that suits his business.

However, as much as marine insurance provides a fair claim to transporters and corporations, it has to be understood that the trickiest and strictest insurance areas when the insurance commenced – i.e. from the 17th century onwards.

While dealing with the scope and range of marine insurance, a ship’s captain must follow a rigid protocol regarding the route taken and the time taken for the cargo and the vessel to reach the intended destination port.

Because if there is any discrepancy or violation in terms of the route taken, i.e. if the captain varies or digresses in his route from the one originally intended as a part of the ship’s course, then even if there is any mishap occurring to the vessel or the cargo, the insurance claim will be rejected entirely without any possibility of the claim being reimbursed to the claimant at some future date after a few tough negotiations.

Therefore it becomes essential that a ship’s captain takes due consideration about the prescribed routes to avoid a failed insurance contract because of an accidental loss due to the deviation in the route. This would bring about caution on the captain’s part and reduce the possibility of losing essential insurance claims because of inadvertence and negligence.

Marine insurance is a haven for shipping corporations and transporters because it helps to reduce the aspect of financial loss due to the loss of critical cargo. Also, it helps to bring about to the transporting companies and the receiving parties the duty, dedication and straightforwardness of the insurance companies.

Table of Contents

Frequently Asked Questions

1. what is marine insurance.

It is a kind of marine insurance policy which covers the losses or damages caused to marine cargo during transit times. Such protection is provided to the cargo owner and the shipment in case of delays, accidents etc.

2. What are the types of Marine Insurance?

There are different kinds of marine insurance, namely, Freight insurance, Liability insurance, Hull insurance and Marine Cargo insurance.

3. Why is marine insurance necessary?

Marine insurance is essential to keep the costly items safe and intact and claim coverage in case of any damages or losses resulting from accidents or collisions.

4. Is it illegal not to have boat insurance?

Most states do not require boaters to have insurance for their watercraft; however, they may come in handy at some marinas or docks if one wishes to use a slip or mooring. Two States- Arkansas and Utah, have boat insurance laws.

5. What are the five principles of marine insurance?

The main principles taken from the 1963 Marine Insurance Act include Indemnity, Insurable Interest, Utmost Good Faith, Proximate Cause, Subrogation and Contribution.

You might also like to read

- Different Types of Marine Insurance & Marine Insurance Policies

- Marine Insurance for Piracy Attacks: Necessities and Benefits

- The Importance of Marine Insurance Brokers

- What is Marine Cargo Insurance and How to Get One?

Disclaimer: The author’s views expressed in this article do not necessarily reflect the views of Marine Insight. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Marine Insight do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendations on any course of action to be followed by the reader.

The article or images cannot be reproduced, copied, shared, or used in any form without the permission of the author and Marine Insight.

Do you have info to share with us ? Suggest a correction

Latest Maritime Knowledge Articles You Would Like :

12 Interesting Facts About the PNS Ghazi Submarine

Differences Between Marines And Navy

10 Interesting Bali Sea Facts

10 Interesting Gulf of Tomini Facts You Must Know

10 Flores Sea Facts You Should Know

4 Major Ports of Albania

Subscribe To Our Newsletters

By subscribing, you agree to our Privacy Policy and may receive occasional deal communications; you can unsubscribe anytime.

Web Stories

i like the information you give on media

A very informative post. Marine insurance is important in case of import and export of goods which is an integral part of the economy. By compensating against the loss of goods and ship, the policy helps exporters and importers bear any losses incurred during transit.

i liked it so mush but can you write about it is polices ,please!!

Leave a Reply

Your email address will not be published. Required fields are marked *

Subscribe to Marine Insight Daily Newsletter

" * " indicates required fields

Marine Engineering

Marine Engine Air Compressor Marine Boiler Oily Water Separator Marine Electrical Ship Generator Ship Stabilizer

Nautical Science

Mooring Bridge Watchkeeping Ship Manoeuvring Nautical Charts Anchoring Nautical Equipment Shipboard Guidelines

Explore

Free Maritime eBooks Premium Maritime eBooks Marine Safety Financial Planning Marine Careers Maritime Law Ship Dry Dock

Shipping News Maritime Reports Videos Maritime Piracy Offshore Safety Of Life At Sea (SOLAS) MARPOL

- Search Search Please fill out this field.

- Personal Finance

Watercraft Insurance: What It is, How It Works

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

What Is Watercraft Insurance?

Watercraft insurance is an umbrella term for three types of insurance: boat insurance , yacht insurance , and personal watercraft insurance. It protects against damages to vessels powered by a motor that has a horsepower of at least 25 miles per hour (mph). Examples of the types of costs covered by watercraft insurance policies include physical loss or damage to the boat, theft of the boat, and towing.

Key Takeaways

- Watercraft insurance is an umbrella term for three types of insurance: boat insurance, yacht insurance, and personal watercraft insurance.

- The type of coverage you buy is dictated by the size of your vessel.

- Although watercraft insurance is not required in many states, many boat owners choose to purchase it anyway.

- Boat-loan providers and marinas often require boat owners to have watercraft insurance.

How Watercraft Insurance Works

Depending on the policy, there may also be watercraft liability coverage for bodily injury to people other than the boat’s owner and family, guest passengers using the boat by themselves, and medical payments for injury to the owner and their family. Some policies, however, require the purchase of additional liability coverage as an add-on. The specific type of insurance you buy is dictated by the size of your vessel.

Watercraft insurance is similar to other types of insurance products. In exchange for paying a series of insurance premiums, the policyholder receives protection from certain rare but potentially costly risks. Depending on factors such as the size of the craft, its age, and its intended uses, the premium costs may range from relatively inexpensive to pricey. When underwriting a policy, an insurance company will also consider the policyholder’s track record of previous claims.

Boat Insurance

Any vessel under 197 feet long is considered a boat, while ships are 197 feet or longer. The dividing line between boat and yacht is less settled. Some sources define a yacht as at least 30 feet long. Anything shorter is a pleasure boat. For insurance purposes, the National Boat Owners Association marks the dividing line at 27 feet.

Small craft, such as canoes, rowboats, small sailboats, and powerboats with less than 25 miles-per-hour horsepower may be covered under a standard homeowners or renter’s insurance policy. However, such coverage is unlikely to include liability insurance. Typical boat insurance covers theft; physical damage to the boat itself due to a collision or striking a submerged object; property damage to the boat caused by vandalism, a windstorm, or lightning; and medical payments for injured passengers and the owner and their family. For each coverage, there will be different deductibles, which is how much you must pay out of pocket before your insurance kicks in. Boat insurance will often provide better liability insurance than a homeowners policy, but it is often wise to purchase additional liability coverage as an add-on.

In the event of a total loss, it is important to know whether your policy pays actual cash value (ACV) or agreed value (AV). ACV is cheaper because it only pays for what the boat was worth at the time of the loss, factoring in depreciation and wear and tear on the vessel. AV pays a price that you and your insurer agree upon in advance, an amount that is likely to be closer to the amount you paid for the boat when new.

Other considerations for boat insurance can include:

- Lay-up period —This covers your boat for property damage during the off-season, when it isn’t in the water.

- Navigational territory —Your insurance will generally specify where you can go in your boat and still be covered.

- Property damage —This is for damage your boat inflicts on someone else’s property.

- Hurricane haul-out provisions —This covers your costs of getting the boat out of harm’s way before a windstorm.

- On-water towing and assistance —This is for unexpected breakdowns or running aground.

- Fuel spill liability protection —Should there be an accidental discharge of fuel from your boat, this will cover the costs of a clean-up.

- Personal effects coverage —This will protect any expensive equipment you have on your boat, such as fishing gear

- Ice and freeze coverage —Should cold weather damage your boat’s engine and water systems, this will pay the bill.

Yacht Insurance

Most yacht coverage is broader and more specialized than pleasure boat coverage because larger vessels travel farther and are exposed to greater risks. It also generally costs more, in part because yachts cost more . In terms of a deductible, it is usually determined as a percentage of the insured value. With a 1% deductible, a boat insured for $175,000 would have a $1,750 deductible. Most lenders allow a maximum deductible of 2% of the insured value.

Generally, yacht insurance coverage does not include wear and tear, gradual deterioration, marine life, marring, denting, scratching, animal damage, osmosis, blistering, electrolysis, manufacturer’s defects, defects in design, and ice and freezing.

There are two main parts of a yacht insurance policy: hull insurance and protection and indemnity (P&I). The first is an all-risk, direct damage coverage that includes an AV for hull coverage, and in the case of a total loss, it will be paid out in full. Replacement cost coverage on partial losses is also available. However, sails, canvas, batteries, outboards, and sometimes outdrives are usually subject to depreciation instead.

P&I insurance is the broadest of all liability coverages, and because maritime law is particular, you will need coverages that are designed for those exposures. Longshore and harbor workers’ coverage and Jones Act coverage (for the yacht’s crew) are included and are important because your losses in these areas could run into six figures. P&I will cover any judgments against you and also pay for your defense in admiralty courts .

Personal Watercraft Insurance

Personal watercraft insurance is for recreational vehicles such as Jet Skis , Sea-Doos, and Yamaha Wave Runners. These surface-skimming craft can have engines with horsepower anywhere from 60 mph to 310 mph. They usually are not covered by homeowners insurance, and even when they are, the coverage limits are low.

Personal watercraft insurance covers the owner and anyone they allow to use the craft for risks such as:

- Bodily injury to another person

- Bodily injury to you that is caused by an uninsured watercraft operator

- Liability in the form of legal costs if you’re sued due to an accident (which can include water sports liability for things such as waterskiing risks)

- Property damage to another watercraft, a boat, or a dock

- Towing after an accident

Deductibles and liability limits will vary depending upon the policy and the company offering it. You can buy additional coverage for trailers and accessories and, if you own more than one craft, you may be able to bundle your insurance policies for a discount. These pleasure vehicles are easy to use but can also be dangerous, causing thousands of injuries every year, which makes personal watercraft insurance a wise investment.

Watercraft insurance policies may limit the geographic areas in which the boat or watercraft can be operated while maintaining coverage. These often include inland waterways, rivers, and lakes, as well as ocean waters within a certain number of miles from shore.

Do I Need Watercraft Insurance?

Only a few states make it mandatory for boat owners to obtain watercraft insurance. However, many owners will opt to purchase it regardless, partly because doing so is required in order to obtain a boat loan . Marinas may also require owners to have watercraft insurance as a condition within their rental agreements.

Even if your craft isn’t worth much money, obtaining watercraft insurance is a good idea because of the risk of injury on the water, especially from a collision. Even if you aren’t at fault, you could spend a lot of money in legal fees defending yourself—much more than your insurance premiums. If you do decide to purchase this insurance, make a point of comparing policies from multiple companies before deciding on which is best for you. As with all insurance, the question is what price you put on having peace of mind.

Insurance Information Institute. " I.I.I.: Know Your Boat’s Insurance Coverage from Stem to Stern ." Accessed Feb. 6, 2022.

Westlawn Institute of Marine Technology. " Definitions of: Boat, Yacht, Small Craft, and Related Terms ." Accessed Feb. 6, 2022.

National Boat Owners Association (NBOA). " The Best Yacht Insurance Rates ." Accessed Feb. 6, 2022.

DiscoverBoating.com. " Boat Insurance Guide: Boat Insurance Coverage FAQs: What is a normal deductible? " Accessed Feb. 6, 2022.

National Marine Lenders Association. " Insurance: Large Boats: What’s Not Covered? " Accessed Feb. 6, 2022.

DiscoverBoating.com. " Boat Insurance Guide ." Accessed Feb. 6, 2022.

Boat Owners Association of the United States (BoatUS). " Do I Need Boat Insurance? " Accessed Feb. 6, 2022.

- Property Insurance: Definition and How Coverage Works 1 of 21

- The Importance of Property Insurance 2 of 21

- What Is Personal Liability Insurance? Definition and Coverage 3 of 21

- Scheduled Personal Property: What it is, How it Works 4 of 21

- Unscheduled Personal Property: What It Is, How It Works 5 of 21

- Floater Insurance: What it is, How it Works, Examples 6 of 21

- Unscheduled Property Floater 7 of 21

- Wear and Tear Exclusion: What it is, How it Works, Claim Disputes 8 of 21

- A Quick Guide on How to Insure Jewelry 9 of 21

- Jewelry Floater: What Is It, and How Does It Work With Insurance? 10 of 21

- Special Insurance for Designer Clothes 11 of 21

- Consignment Insurance: What It Is, How It Works 12 of 21

- A Quick Guide to Landlord Insurance 13 of 21

- Best Landlord Insurance Companies 14 of 21

- Mobile Home Insurance: Do You Need It? 15 of 21

- Modular vs. Manufactured Home Insurance 16 of 21

- Tiny House Insurance: How to Insure Your Tiny Home 17 of 21

- Watercraft Insurance: What It is, How It Works 18 of 21

- Yacht Insurance: What It Means, How It Works 19 of 21

- What Is Umbrella Insurance Policy? Definition and If You Need It 20 of 21

- How an Umbrella Insurance Policy Works 21 of 21

:max_bytes(150000):strip_icc():format(webp)/200270955-001-5bfc2b8bc9e77c00517fd20f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Yacht Insurance

What does yacht insurance mean.

Yacht insurance is a type of insurance policy that indemnifies the cost of accidental loss or damage to yachts or pleasure boat owners. Yacht insurance policies provide comprehensive and third party liability insurance protection.

Insuranceopedia Explains Yacht Insurance

Typical yacht insurance policies cover the boat, machinery, theft, and damage. One unique aspect of yacht insurance is that coverage covers damages that occur at sea, while the yacht is moored, while it is kept on land, or while it is in transit.

Related Definitions

Managing general agent (mga), inland marine policy, multiple indemnity, policy reserve, position schedule bond, qualified pension plan, refund annuity, refund life income option, rental value insurance, related terms, unvalued marine policy, jewelry insurance, personal property floater, unscheduled property floater, comprehensive insurance, transit insurance, water damage clause, watercraft nonowned insurance, watercraft endorsement, travel insurance, related articles, maternity coverage: does your insurance have you covered, insurance tips for newlyweds, important insurance coverage for seniors, what canadians need to understand about their travel insurance, farm insurance: 9 essential policies to know, related reading, trending articles.

- Seller Market Analysis

- Trade Your Yacht

- Vessel Donation

- Sold Yachts

- We Buy Boats

- Exclusive Listings

- Yachts for Sale

- New Yacht Builds

- Nautor Swan Yachts

- Sichterman Yachts

- Luxury Yacht Charters

- Search Charter Yachts

- Charter Management

- Luxury Events

- Team Members

- Boat Show Events

- North Report Magazine

- Testimonials

- +1.954.900.9988

Blog | A-Z Guide to Luxury Yacht Insurance

Although in many states, the law doesn’t require owners to carry yacht insurance, most yachts are insured because of the astronomical cost of repairs. Yacht insurance is also typically required by banks, marinas, yacht clubs and the federal government to cover crew-related liabilities (unless the vessel is owner-operated).

However, because each yacht is highly unique in size, systems, crewing and operational geography, buying yacht insurance is much more complex than insuring a car, for example. Yacht insurance policies are tailored to individual vessel needs, and owners can benefit from dissecting the elements of a policy so they know what questions to ask and what exclusions and inclusions to pay attention to.

YACHT INSURANCE 101

All yacht insurance policies offer two key coverages – physical damage and liability. Physical damage coverage includes repairs of the hull, machinery and equipment, but exceptions apply and they vary from one insurer to another. Ask your broker in detail which physical elements and systems are covered and which are not.

Liability coverage protects you from claims of damage to persons or property. The scope of these claims can be quite extensive and include damage to other vessels, port equipment and facilities, as well as injury or death. Your coverage must include environmental damage remediation, such as cleaning up oil contamination or removing a wrecked vessel from the water, and it must cover incidents involving onshore marine workers and crew members, as per federal law.

Yacht insurance can include many types of protection for policyholders, but insurers vary in what risks they will and will not cover. That’s why it’s so important to review exclusions in detail. You don’t want to discover something isn’t covered after the fact.

WATER CRAFTS AND ‘TOYS’

Personal water crafts and ‘toys’ – from jet skis and seabobs to submersibles – are expensive assets that should also be insured. Review your vessel policy with your broker to see if yacht insurance covers these water toys and equipment. If this is not the case, you may need to get a separate policy for each of these items.

INSURANCE COVERAGE DURING LAND STORAGE OR TRANSPORTATION

If you have to transport your yacht by land or on a yacht delivery ship, you will need a policy that extends to those cases. Under the U.S. Carriage of Goods at Sea Act, the steamship line liability for damages to your yacht can be as low as $500, so you may need to supplement that with further coverage. Similarly, if you keep your yacht on land during the off-season, you will need to cover fire and other natural perils, as well as theft and vandalism.

UNINSURED BOATER COVERAGE

Although most yacht owners carry comprehensive insurance, some owners still do not. An uninsured boater policy protects you in the event that you or someone on board your yacht sustains injuries during an incident with a vessel that has no insurance.

EMERGENCY TOWING AND WRECK REMOVAL

Whenever you need fuel delivered at sea or towed to a place of repair, you want to have these costs covered by yacht insurance. Review your policy to check if there is a limit on these costs or a limited number of towing services per year. Similarly, if the yacht is wrecked as a result of a major accident or disaster and becomes an environmental or navigational hazard, you want coverage that will pay for salvage and disposal.

WHAT IS TYPICALLY EXCLUDED FROM YACHT INSURANCE?

Although many yacht insurance policies are quite comprehensive, there are always certain types of damage or liability either not reimbursed or categorized as “extras”. Here are some issues typically excluded from normal wear and tear coverage:

Insects, Mold and Marine Life Encounters

Mold and pests can cause costly damage to the hull, decks, interior or equipment, but they are not covered by insurance. For example, if a shark sinks its teeth into the stern (unlikely) or bugs eat through soft goods during winter storage (more likely), you’ll need special coverage to pay for those repairs.

Negligence, Boating Under Influence and Racing

Like other insurance policies, yacht insurance excludes losses through negligence or willful misconduct. If your yacht is involved in an incident due to someone operating it under the influence, your insurer may reject the claim outright or only the liability portion. Racing may be another excluded event and require its own dedicated policy.

Geographical Limitations

Most yacht insurance plans extend to specific cruising areas and deactivate when a yacht sails beyond these navigational limits. Yacht owners must ensure their navigation area is covered by insurance. In addition, many policies require yachts to be stored above certain latitudes during hurricane season. Owners should be aware of these requirements or have their insurance plans extended to where the yacht is moored.

AGREED VALUE VS. ACTUAL CASH VALUE

In addition to the scope of coverage, most owners are concerned with the amount of insurance compensation, insurance premiums and their impacting factors. How an insurer values your claim is a big factor in determining both compensation and premiums.

If you elect to carry an ‘agreed-value’ policy, you get the exact amount shown on the policy when it is signed, minus your deductible. This option comes with higher premiums, but it’s preferred by many owners. Your other option is an ‘actual cash value’ (ACV) policy, where the insurer factors depreciation into the claim value, resulting in lower annual premiums.

BEST OPTIONS TO BUY YACHT INSURANCE

While smaller boats can be insured by your home insurance, owning a mega yacht always calls for a tailored insurance plan. A comprehensive yacht insurance policy should cater to specific risks associated with navigating a larger vessel on high seas, including the liability to your crew or other boaters, damage to water toys or other property aboard or sailing in certain geographic regions.

Many owners turn to yacht brokers or professional maritime insurance providers, like Oversea Insurance Agency, who leverage a worldwide network to offer 24/7 assistance all over the globe. By having a comprehensive yacht insurance plan from industry experts, yacht owners can rest assured that they will receive the most comprehensive insurance coverage and full support from initial consultation to insurance claim resolution.

Recent Stories

Navigating luxury: chartering a yacht in the british virgin islands, embark on luxury: yachting in newport, ri with 26 north yachts.

Talk to us Contact Our Team

I understand that by signing up I agree with 26 North’s Privacy Policy .

Welcome aboard!

We have added you to the newsletter.

We have received your information and an agent will get back to you ASAP

Sign up for Yoga On the Docks Tuesdays at 8 AM

We have received your registration. See you on the docks!

Financial Tips, Guides & Know-Hows

Home > Finance > Yacht Insurance Definition

Yacht Insurance Definition

Published: February 19, 2024

Understand the finance aspect of yacht insurance with our comprehensive definition and guide. Protect your investment with the right coverage.

- Definition starting with Y

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

Understanding Yacht Insurance: Coverage, Benefits, and Importance in the Maritime World

When it comes to your prized yacht, protecting your investment is of utmost importance. Yacht insurance provides the financial safety net and peace of mind that every yacht owner needs. In this blog post, we will explore the definition of yacht insurance, its coverage, benefits, and why it is crucial in the maritime world.

Key Takeaways:

- Yacht insurance covers damages to the yacht, liability protection, and personal property coverage.

- Comprehensive yacht insurance policies can provide coverage for a wide range of risks, including accidents, theft, natural disasters, and personal injury liability.

What is Yacht Insurance?

Yacht insurance is a specialized type of coverage designed to protect yacht owners from financial loss due to damages, theft, accidents, and other unfortunate events related to their vessel. It provides financial assistance for repairs, replacement, or legal expenses, ensuring that yacht owners can continue enjoying their maritime adventures without worrying about significant financial setbacks.

What Does Yacht Insurance Cover?

Yacht insurance typically includes three main areas of coverage:

- 1. Hull Coverage: This part of the policy covers physical damage to the yacht itself, including repairs or replacement costs arising from accidents, collisions, storms, sinking, or even fire and explosion risks.

- 2. Liability Protection: Yacht owners can be held liable for accidents, injuries, or property damage caused by their vessel. Liability protection within yacht insurance covers legal expenses, medical bills, and compensation payments for third-party claims.

- 3. Personal Property Coverage: Yacht insurance also extends coverage to personal belongings onboard, such as electronics, furniture, jewelry, and other valuables, safeguarding them against loss, theft, or damage.

Why is Yacht Insurance Important?

Yacht insurance is vital for several reasons:

- 1. Financial Protection: Yacht ownership involves significant financial investment, and unexpected damages or accidents can lead to substantial financial loss. Yacht insurance provides the necessary financial safety net, ensuring that owners can recover from such losses without facing financial turmoil.

- 2. Compliance with Marina and Lender Requirements: Many marinas and lenders require yacht owners to have insurance coverage in order to dock their vessels or secure financing. Having yacht insurance not only protects your investment but also allows you to comply with these requirements.

- 3. Peace of Mind: Knowing that your yacht is protected provides peace of mind, allowing you to fully enjoy your time on the water without worrying about potential risks or incidents.

In conclusion, yacht insurance is a crucial aspect of yacht ownership, providing comprehensive coverage and financial protection for yacht owners. Whether you own a small pleasure yacht or a luxurious vessel, having yacht insurance in place ensures that you can navigate the seas with confidence and security.

If you’re looking to sail stress-free and protect your prized possession, consider exploring yacht insurance options and find a policy that suits your needs.

Our Review on The Credit One Credit Card

20 Quick Tips To Saving Your Way To A Million Dollars

Where Can I Get A Money Order With Credit Card

Front Office: Definition, Duties, Front Office Vs. Back Office

Latest articles.

Next-Level Learning: Examining the Advantages of Online Post-Master’s FNP Education

Written By:

The Recipe for a Balanced Life: Mixing Online Learning With Health and Wellness

Money Matters: Master Your Financial Future

Accounting For Photographers: Important Tips

Perfect Guide for Dissertation Proofreading

Related post.

By: • Finance

Please accept our Privacy Policy.

We uses cookies to improve your experience and to show you personalized ads. Please review our privacy policy by clicking here .

- https://livewell.com/finance/yacht-insurance-definition/

About Chubb: About Chubb

About Chubb: About Chubb in the U.S.

About Chubb: Careers

About Chubb: Citizenship

About Chubb: Investors

About Chubb: News

Claims: Claims

Claims: Claims Difference

Claims: Claims Resources

Claims: Report a Claim

Login / Pay My Bill: Login for Business

Login / Pay My Bill: Login for Individuals

Login / Pay My Bill: QuickPay for Businesses

Login / Pay My Bill: QuickPay for Individuals

Login / Pay My Bill: Login to CRS

Contact Us: Contact Us

Contact Us: Global Offices

- File a claim

- Get a quote

Yacht Insurance

Protect your superior watercraft with superior protection from Chubb.

Chubb has been a leading provider of yacht insurance for over 100 years, offering some of the most comprehensive policies available for private, pleasure watercrafts. Being on the water is an experience of peace, calm, and new adventures on the horizon. It’s an experience you want to protect. Our Masterpiece® Yacht insurance policy offers superior coverage for pleasure yachts 36 feet or greater in length. And for captained vessels 70 feet or greater in length and valued at $3 million or more, our Masterpiece Yacht Preference policy has the specialty coverages you and your crew need.

Masterpiece® Yacht Policy Highlights

Agreed Value Coverage

We pay the entire agreed amount, with no deductible, for a total loss. With our Masterpiece Yacht Select policy, eligible vessels can receive Replacement Cost coverage up to 120%.

Liability Protection

Limits of coverage to suit your personal needs, including: legal defense costs, liability as required by the Oil Pollution Act of 1990, wreck removal, and Jones Act coverage for paid crew.

Replacement Cost Loss Settlement

Repair or replacement of covered property is paid for without deduction for depreciation for most partial losses.

Uninsured/Underinsured Boater Coverage

Pays for bodily injury to persons aboard the insured watercraft who are injured by an uninsured owner or operator of another vessel.

Medical Payments

Reasonable medical and related expenses are included for all those onboard, boarding or leaving the covered vessel. These benefits are provided on a per person basis, rather than per occurrence. Optional and customized limits are available.

Search & Rescue

Up to $10,000 for the expenses incurred by an insured in relation to a governmental unit such as the United States Coast Guard (USCG) who provide emergency aid and assistance are included for no additional charge. With our Masterpiece Yacht Select option, coverage is available up to $25,000.

Longshore and Harbor Workers’ Compensation Act (LHWCA)

When Liability coverage is purchased, coverage is automatically provided for those employed aboard the vessel who are within the jurisdiction of the LHWCA.

Personal Property & Fishing Equipment Coverage

Protection is automatically included for the clothing, personal effects and fishing gear of the boat owner and their guests. Optional higher limits are available.

Coverage for Marinas as Additional Insured

Marinas, yacht clubs and similar facilities where clients keep their vessels are included as Additional Insureds.

Trailer Coverage

We automatically include coverage up to $5,000 for your trailer used with your insured vessel. Higher limits are available.

Emergency Towing & Assistance

Our policy includes this coverage with optional higher limits available.

Boat Show & Demonstration Coverage

We automatically provide this coverage, at no additional charge.

Precautionary Measures

We will pay up to the policy limit the reasonable costs incurred to haul, fuel or dock the insured watercraft endangered by a covered peril.

Bottom Inspection

We will cover the reasonable costs to inspect the bottom of an insured vessel after grounding, stranding, or striking a submerged object. There is no deductible for this coverage.

Oil Pollution Act of 1990 (OPA) Coverage

If Liability coverage is purchased, our policy provides coverage in addition to the Liability limit, up to the required OPA statutory limits, regardless of the Liability limit chosen. Additionally, if the OPA statutory limit is increased in the future, our policy will automatically increase the applicable OPA limit to match the new higher statutory limits.

Temporary Substitute Watercraft

Up to $5,000 to charter a temporary substitute watercraft if the insured vessel is out of commission due to a covered loss and cannot be repaired within 72 hours. With our Masterpiece Yacht Select policy offering, the limit of Temporary Substitute Watercraft is increased to $10,000.

Marine Environmental Damage Coverage

This feature provides protection up to $10,000 for fines and penalties as a result of marine environmental damage, as defined by the policy terms. Coverage is provided in addition to the insured's applicable Liability and OPA limits. With our Masterpiece Yacht Select policy offering, the limit of Marine Environmental Damage Coverage is increased to $25,000.

57% of boating accidents happen on calm days with waves less than 6 inches.

Chubb offers some of the most comprehensive protection and services available rain or shine.

*Source: 2016 Recreational Boating Statistics, United States Coast Guard

Masterpiece Yacht Preference

Masterpiece Yacht Preference fulfills the specialty insurance needs of luxury yacht owners with captained vessels 70 feet in length and greater, valued at $3 million or more.

No depreciation applies on the following items

Machinery inside the hull, Personal Property, dingy/tender, and Personal Watercraft.

Emergency Towing Service

We include coverage up to the amount of Property Damage with no deductible.

The medical payments limit offered is on a per occurrence basis, and we will pay costs incurred up to three years from the date of occurrence.

Marina as Additional Insured

The marina, yacht club, or similar facility where the insured yacht is docked, moored, or stored is included as an Additional Insured.

Captain and Crew Coverage

Liability coverage is extended to the captain and crew members serving aboard the insured yacht.

Defense Costs

Defense costs are included in addition to the limit of liability and includes up to $50,000 loss of earnings.

Mooring or Slip Rental Agreement Waiver

When waiver of subrogation is required through a written contract by a yacht club, marina, or similar facility used for the purpose of storage or slip rental, our Masterpiece Yacht Preference policy will permit an insured to waive their rights of subrogation.

Masterpiece® Recreational Marine Insurance Brochure

Your client’s guide to watercraft protection. Make sure they’re protected, with the right coverage, so they can relax on and off the water.

Related Coverage

We provide exceptional boat insurance with tailored protection.

We help you stay ahead and informed with these helpful tips and tricks

12 safety tips for recreational boaters

As the weather warms up, many of us head to lakes, rivers, or the ocean to fish, waterski, cruise, and relax onboard a boat, yacht or other personal watercraft.

Understanding boat insurance

A comprehensive guide to finding the right boat insurance coverage.

This information is descriptive only. All products may not be available in all jurisdictions. Coverage is subject to the language of the policies as issued.

Find an Agent

Speak to an independent agent about your insurance needs.

Marsh.com Login

Please log in to access the full marsh.com site.

Click here to login as colleague

Yacht insurance: What every owner should know

Although most owners know the importance of a yacht or boat insurance policy, the terms and conditions can be challenging to fully comprehend. Ensuring your yacht is appropriately insured means being clear on what a policy covers and excludes.

What is yacht insurance?

Normally, owners would want or require protection against the following:

- Loss of, or damage to, their own property (i.e. the boat);

- Liabilities to third parties

Therefore, a typical yacht insurance policy, such as Marsh YachtCover, will have two basic sections:

Section 1: Hull and Machinery (H&M)

This section covers loss or damage to the boat and its machinery — including the hull, engines, sails, personal property, and equipment necessary to operate the boat.

Marsh YachtCover typically uses an "All Risks" wording, which provides cover against all perils to which the yacht may be exposed, with the exception of some named exclusions.

The most common causes of loss include:

- Perils of the sea (e.g. grounding, stranding, heavy weather damage, capsizing or sinking)

- Contact and collisions (e.g. with other vessels or docks)

- Fire and explosion

- Accidental damage (e.g. during loading, discharging or moving stores, gear, equipment)

- Theft or vandalism

- Like all insurances, yacht insurance will only pay for a loss if the loss is “fortuitous” — meaning that the loss must be accidental in some sense and not certain to occur. Therefore, insurers exclude: Loss caused by inherent vice or ordinary wear and tear.

- Loss caused by willful misconduct of the assured.

The number and type of exclusions differ from insurer to insurer. Check your full policy wording to ensure you have the coverage you require.

Tip : Check that your insurance policy extends to cover the yacht when stored on land, and whilst in transit on the road by trailer.

Section 2: Protection and Indemnity (P&I)

This section covers legal obligations to other parties — such as bodily injury, loss of life, pollution, or damage to a third-party property — while the boat is operating or under your ownership. Liabilities include:

- Third-party property damage : including loss or damage to any other boat, harbour, or dock caused by your boat.

- Wreck removal : the cost of raising, removing and destruction of the wreck if legally required.

- Bodily injury : claims for loss of life, personal injury, and illness of guests onboard.

- Pollution : including cost of clean-up, prevention measures, and third-party liabilities involving an accidental discharge.

- Legal costs : including the cost of correspondents, lawyers, surveyors, and experts required to handle any claim or legal defence.

You can also extend your liability coverage to include watersports.

Additional Coverage Features

Marsh YachtCover typically includes other coverage features that enhance your level of protection, such as:

- Medical Payments Covers reasonable medical expenses for all on-board, boarding, or leaving the insured boat on a per person basis. This may include the cost of an ambulance, treatment, and hospital charges.

- Emergency Assistance Pays for the costs incurred when emergency assistance is required, even if you and your yacht are not in immediate danger, such as towing a yacht stranded at sea.

- Uninsured Boater Coverage Pays for bodily injury to persons aboard the yacht who are injured by an uninsured owner or operator of another yacht.

- Bottom Inspection Pays for reasonable costs incurred for boat inspection after grounding, stranding, or striking a submerged object even if no damage is found, without application of any deductible.

- Marine Habitat Pays for damages that you are legally obliged to pay if you cause damage to marine habitat through physical contact with the yacht, such as dropping anchor onto a protected coral reef.

In addition, Marsh YachtCover offers optional cover depending on your needs and requirements:

- Boat Show and Demonstration Coverage Covers the boat while exhibited during recognised boat shows, sea trials, and while the yacht is being navigated for demonstration purposes.

- Personal Accident Coverage Unlike coverage under the P&I section, this is a no-fault product that can provide accidental death or permanent disablement benefits for insured persons, including the individual yacht owner, whether or not the accident is related to the yacht itself.

- Crew Liability Liabilities to crew are excluded under typical yacht insurances. Therefore, if you employ crew you will need to purchase a standalone yacht liability insurance for a limit of up to US$500 million. This can also be extended to include Personal Accident Coverage for them, as described above.

Protect with Marsh YachtCover

Marsh YachtCover provides comprehensive yacht insurance coverage for yachts valued above US$500,000 and up to a maximum of US$18 million and is supported by a team of experienced brokers and claims specialists who have served over 700 owners across Asia. Contact us to receive a quotation today.

Essential information on yacht insurance

A hassle-free guide to filing a yacht insurance claim

Are there benefits to using a yacht insurance broker?

Marsh yachtcover.

Venture out to sea with confidence

Peeravut Sukho

Country Sales Leader, Thailand

Please note that Marsh PB Co., Ltd and Marsh McLennan are not engaged by nor involved in any manner with Bonus Ranch and its promotion, and has not placed any insurance for nor insured any of its businesses or operations. Marsh as a licensed insurance broker will not request customers to make payment via non-standard methods, such as the transfer of money to any individual’s bank account.

- Oct 18, 2023

Understanding Yacht Insurance - What You Need to Know

For those who own or dream of owning a yacht, the allure of open waters and boundless adventure is an irresistible siren song. Whether you're a seasoned sailor or a novice, navigating the world of yacht ownership involves much more than just hoisting the sails and setting a course. One crucial aspect of yacht ownership that often goes overlooked is insurance. Yacht insurance is a complex and highly specialized field that demands a keen understanding, as it can mean the difference between smooth sailing and a financial shipwreck.

Types of Yacht Insurance

Yacht insurance comes in various forms, each tailored to meet specific needs and circumstances. The three primary types of yacht insurance are:

a. Hull Insurance: This is the equivalent of comprehensive coverage for a car. It protects the yacht's physical structure, including the hull, equipment, and machinery, against damage from accidents, weather, theft, and vandalism.

b. Liability Insurance: Liability insurance covers the costs associated with bodily injury or property damage caused to others while operating your yacht. This type of coverage is essential for protecting your assets and financial well-being in case of an accident.

c. Personal Property Insurance: Personal property insurance covers the belongings and equipment aboard your yacht, such as electronics, appliances, and personal items. It's vital for ensuring that your possessions are protected, especially when spending extended periods on the water.

Determining Coverage Needs

The coverage you require for your yacht depends on several factors, including the value of your vessel, its intended use, your cruising grounds, and your financial situation. To assess your coverage needs accurately, consider the following:

a. Yacht Value: The value of your yacht is a significant factor in determining the insurance premium. The more expensive your yacht, the higher the premium. Make sure your coverage adequately reflects the current market value of your vessel.

b. Usage: The intended use of your yacht also plays a role in determining the type and level of coverage you need. Whether you plan to use your yacht for weekend getaways, long-term cruising, or chartering can impact your insurance requirements.

c. Cruising Grounds: The waters you plan to navigate can influence your insurance policy. Some areas may be riskier due to severe weather, piracy, or other potential hazards. Insurance rates may differ depending on your chosen cruising grounds.

d. Personal Financial Situation: Assess your financial situation to determine the level of coverage you can afford and how much risk you are willing to bear. A comprehensive policy may be more expensive, but it offers greater protection in the event of a claim.

Navigating Policy Exclusions

Yacht insurance policies often come with various exclusions that limit coverage. Understanding these exclusions is crucial to avoid unexpected setbacks. Common exclusions may include:

a. Wear and Tear: Yacht insurance typically does not cover damages resulting from normal wear and tear. Regular maintenance and proper care are essential to minimize such risks.

b. Acts of War: Most policies exclude coverage for damages incurred during acts of war or civil unrest. Make sure you are aware of the political and security situation in the area.

c. Negligence: Negligence on the part of the yacht owner or crew may result in claim denials. It's vital to follow best practices in yacht operation and safety.

Additional Coverages

Yacht owners can opt for additional coverages to enhance their insurance policies, including:

a. Salvage Coverage: Salvage coverage protects against the costs of recovering a yacht after an accident, such as running aground or sinking.

b. Pollution Liability: Yachts can accidentally release pollutants into the water. Pollution liability coverage helps pay for the cleanup costs and fines associated with such incidents.

c. Uninsured Boater Coverage : This coverage protects you against damages caused by another boater who lacks adequate insurance or is uninsured.

Reducing Insurance Costs

While yacht insurance is a necessary expense, there are ways to reduce your premiums:

a. Safety Measures : Implement safety features and practices on your yacht, such as security systems, fire extinguishers, and crew training. Insurance companies often reward safety-conscious owners with lower rates.

b. Higher Deductibles : Consider accepting a higher deductible in exchange for lower premiums. This can reduce your upfront costs but means you'll pay more in the event of a claim.

c. Bundling : If you have other insurance policies (e.g., home or auto), consider bundling them with your yacht insurance to receive discounts.

GYS is Here to Assist Every Step of the Way

Yacht insurance is an essential aspect of yacht ownership that requires careful consideration. Understanding the types of insurance available, determining your coverage needs, navigating policy exclusions, and exploring additional coverages are all vital steps in safeguarding your investment and ensuring peace of mind on the open waters. By taking a proactive approach to your yacht insurance, you can enjoy the beauty and excitement of yacht ownership without the worry of unexpected financial setbacks.

- Buying A Yacht

Recent Posts

Questions to Ask When Buying a Used Yacht

Purchasing a Used Yacht - Things to Consider

Yacht Resale Trends: What Buyers and Sellers Need to Know

Table of Content

- What is Marine Insurance

Marine Insurance Act 1963

- How Marine Insurance works

Types of Marine Insurance

- Which clauses cover Marine Insurance

Difference between Fire Insurance & Marine Insurance

Explore Drip Capital’s Innovative Trade Financing Solutions

13 July 2021

Marine Insurance | Meaning, Types, Benefits & Coverage

What is marine insurance.

Marine insurance refers to a contract of indemnity. It is an assurance that the goods dispatched from the country of origin to the land of destination are insured. Marine insurance covers the loss/damage of ships, cargo, terminals, and includes any other means of transport by which goods are transferred, acquired, or held between the points of origin and the final destination.

The term originated when parties began to ship goods via sea. Despite what the name implies, marine insurance applies to all modes of transportation of goods. For instance, when goods are shipped by air, the insurance is known as the contract of marine cargo insurance.

Importance of Marine Insurance

Marine insurance is required in many import-export trade proceedings. Admitting the terms, both parties are liable for the payment of goods under insurance. However, the subject matter of marine insurance goes beyond contractual obligations, and there are several valid arguments necessary for buying it before dispatching the export cargo.

Goods in transit need to be insured by one of the three parties:-

- The Forwarding Agent

- The Exporter

- The Importer

Also, it can be taken by anyone involved in the transit of goods.

Also Read: Role of a Freight Forwarder | Functions, Duties & more

Where to get Marine Insurance?

The process to purchase marine insurance in India is easy. The country’s geographical position allows many banks and financial institutions to provide marine insurance.

The Marine Insurance Act, in India, came into existence in 1963. As per section three of the act, any time the term ‘marine insurance’ is used, expressed or even extended for the insuring of goods against loss or damage, the insurer will be at risk to bear the charges. The insurer will consider all the certainty of goods in case of misfortune sustained during marine ventures.

Principles of Marine Insurance

Principle of Good faith - Parties demand absolute trust on the part of both; the insurer and the guaranteed.

Principle of Proximate Cause - The proximate cause is not adjacent in time; also, it is inefficient. Nevertheless, it is the definitive and adequate cause of loss.

Principle of Insurable Interest - Any object presented as a marine risk and the assured covering the insurance of goods - both should have legal relevance. Also, a series is devoted called 'Incoterms' to respectfully assign the insurance of goods to each party.

Principle of Indemnity - The insurance extended to the parties will only be applicable up to the loss. The parties can't buy insurance to gain profits. If they do, they won't get more than the actual loss.

Principle of Contribution - Sometimes, the risk coverage for goods has more than one insurer. In such cases, the amount has to be fairly distributed amongst the insurers.

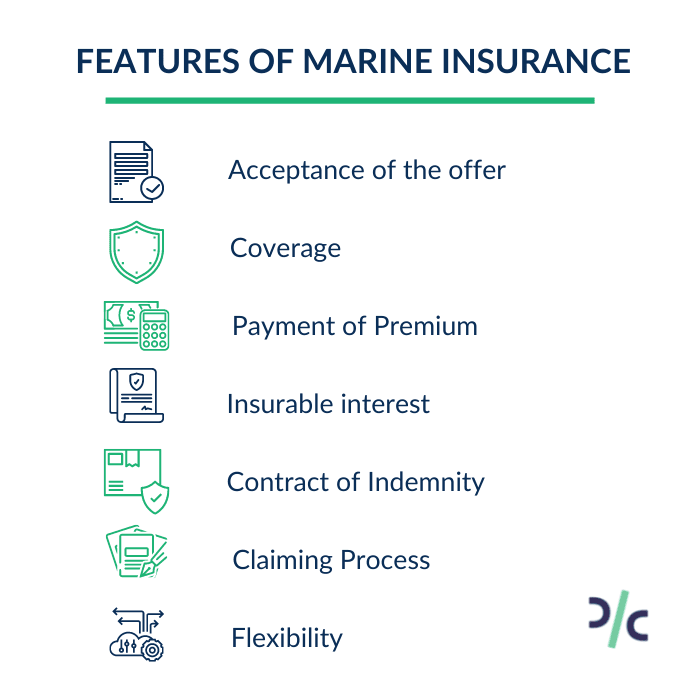

Features of Marine Insurance

How Marine Insurance works?

Marine insurance best transfers the liability of the goods from the parties and intermediaries involved to the insurance company. The legal liability of the intermediaries handling the goods is limited to begin with. The exporter, instead of bearing the sole responsibility of the goods, can buy an insurance policy and get maritime insurance coverage for the exported goods against any possible loss or damage.

The carrier of the goods, be it the airline or the shipping company, may bear the cost of damages and losses to the goods while on board. However, the compensation agreed upon is mostly on a ‘per package’ or ‘per consignment’ basis. The coverage so provided may not be sufficient to cover the cost of the goods shipped. Therefore, exporters prefer to ship their products after getting it insured the same with an insurance company.

The Scope of Marine insurance is necessary to meet the contractual obligations of exports. To align with agreements such as cost insurance and freight (CIF) or carriage and insurance paid (CIP) , the exporter needs to take marine insurance to protect the buyer’s or their bank’s interest and honor the contractual obligation. Similarly, in the case of Delivered Duty Unpaid (DDU) and Delivered Duty Paid (DDP) terms, the seller may not be obligated to insure the goods, although in practice they generally do.

To get marine insurance and avoid insurance claims, ensure the following:

Packing of goods should be done keeping in mind their safety during loading and unloading

Packing should be good enough to withstand natural hazards to the best extent possible

Keep in mind the possibility of clumsy handling or theft when packing goods.

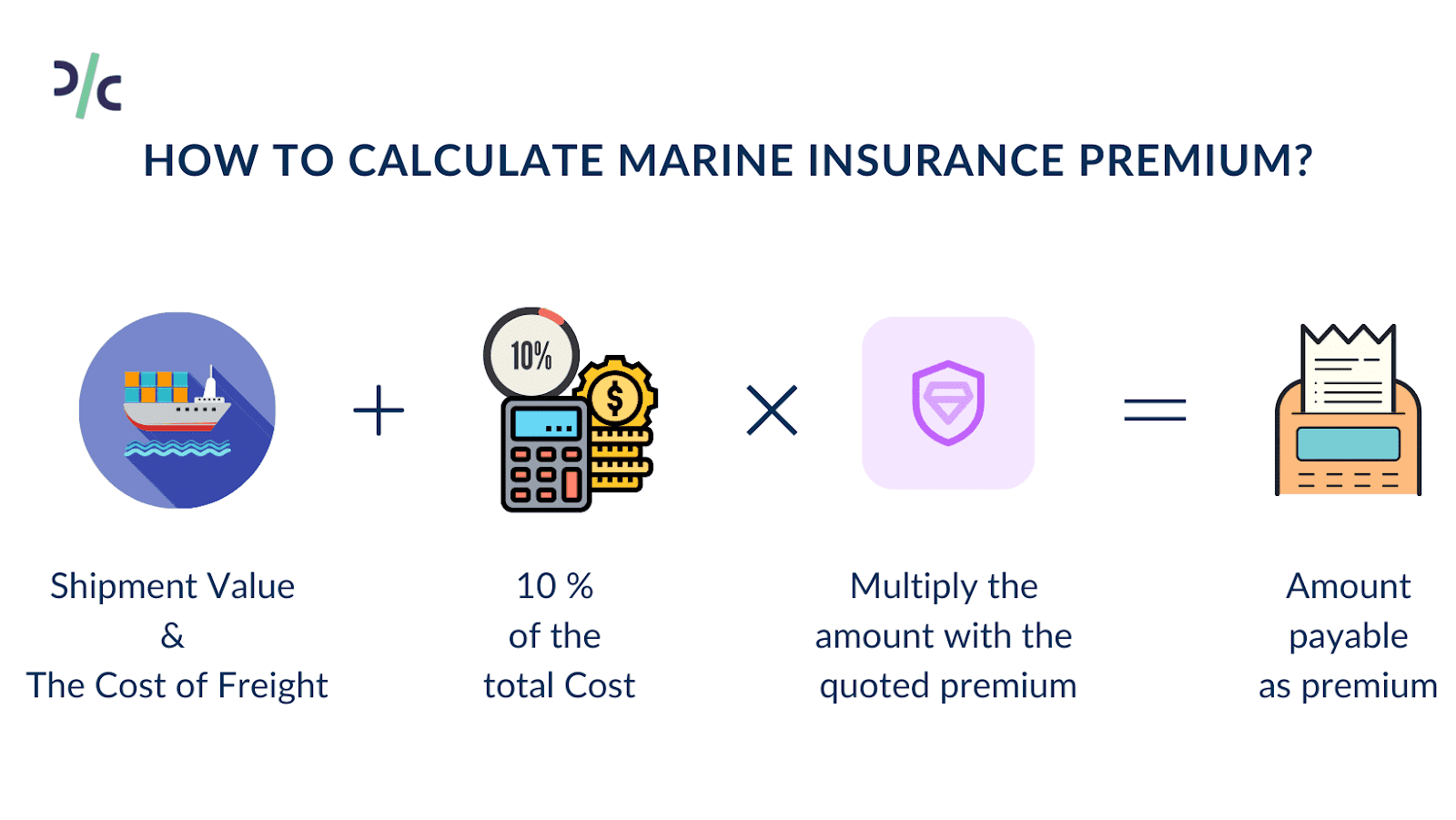

How to calculate Marine Insurance Premium?

Freight Insurance

Liability insurance, hull insurance, marine cargo insurance.

In freight insurance, for example, if the goods are damaged in transit, the operator would lose freight receivables & so the insurance will be provided on compensation for loss of freight.

Marine Liability insurance is where compensation is bought to provide any liability occurring on account of a ship crashing or colliding.

Hull Insurance covers the hull & torso of the transportation vehicle. It covers the transportation against damages and accidents.

Marine cargo policy refers to the insurance of goods dispatched from the country of origin to the country of destination.

Types of Marine Insurance policies

- Floating Policy

- Voyage Policy

- Time Policy

- Mixed Policy

- Named Policy

- Port Risk Policy

- Fleet Policy

- Single Vessel Policy

- Blanket Policy

Floating policy

Floating in Marine Insurance policy, large exporters may opt for an open policy, also known as a blanket policy, instead of taking insurance separately for each shipment. An open policy is a one-time insurance that provides insurance cover against all shipments made during the agreed period, often a year. The exporter may need to declare periodically (say, once a month) the detail of all shipments made during the period, type of goods, modes of transport, destinations, etc.

Voyage policy

A specific policy can be taken for a single lot or consignment only. The exporter needs to purchase insurance cover every time a shipment is sent overseas. The drawback is that extra effort and time is involved each time an exporter sends a consignment. With open policies, on the other hand, shipments are insured automatically.

Time policy

Time policy in marine insurance is generally issued for a year’s period. One can issue for more than a year or they may extend to complete a specific voyage. But it is normally for a fixed period. Also under marine insurance in India, time policy can be issued only once a year.

Mixed policy

Mixed policy is a mixture of two policies i.e Voyage policy and Time policy.

Named policy

Named policy is one of the most popular policies in marine insurance policy. The name of the ship is mentioned in the insurance document, stating the policy issued is in the name of the ship.

Port Risk policy

It is a policy taken to ensure the safety of the ship when it is stationed in a port.

Fleet policy

Several ships belonging to the company/owner are covered under one policy. Where it has the advantage of covering even the old ships. Also the policy is a time based policy.

Single Vessel policy

In single vessel policy only one vessel is covered under marine insurance policy.

Blanket policy

In this policy, the owner has to pay the maximum protection amount at the time of buying the policy.

Which clauses cover Marine Insurance?

The Maritime insurance coverage provided by marine insurance can be understood by going through the risks handled by the insurance policies loaded with various marine insurance clauses:

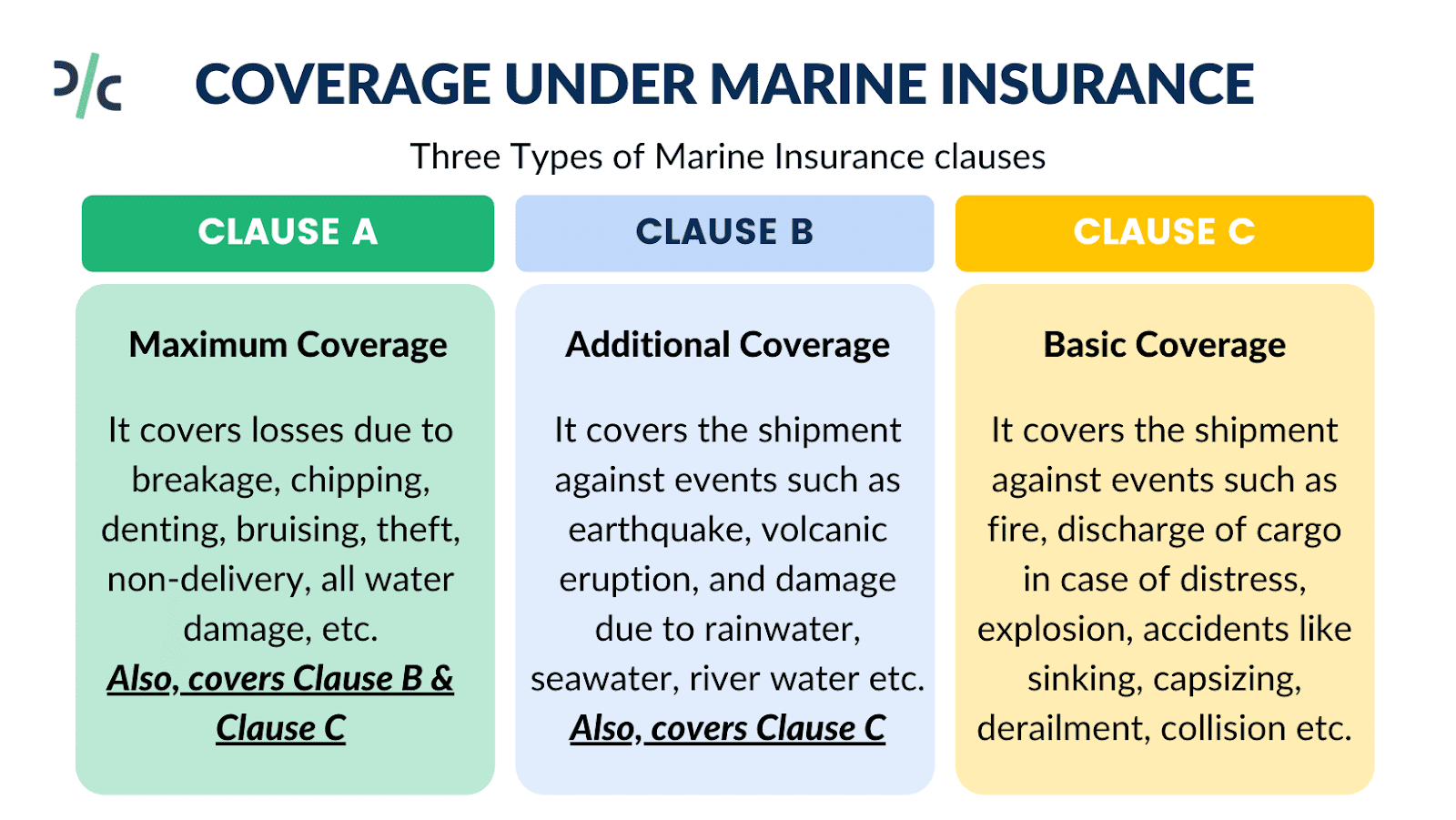

Institute Cargo Clause C provides basic coverage and includes a restricted list of risk covers. It covers the shipment against events such as fire, discharge of cargo in case of distress, explosion, accidents like sinking, capsizing, derailment, collision, etc.

Institute Cargo clause B offers an additional layer of protection. Not only does it include all the risk covers provided under Clause C, but it also covers the shipment against events such as earthquake, volcanic eruption, and damage due to rainwater, seawater, river water, etc., and loss to package overboard or during loading and unloading.

Institute Cargo Clause A provides maximum coverage as it covers all risk of loss or damage to the goods. Apart from the risks covered under Clauses B and C, it also covers losses due to breakage, chipping, denting, bruising, theft, non-delivery, all water damage, etc.

Risks such as wars, strikes, riots, and civil commotions are not covered under the institute cargo clauses. However, the insurer may provide this cover on payment of additional marine insurance premium.

So in terms & conditions of marine insurance coverage, these three types of marine insurance clauses: Institute Cargo Clauses A, B, and C. Clause A provides maximum coverage, Clause C provides basic risk coverage.

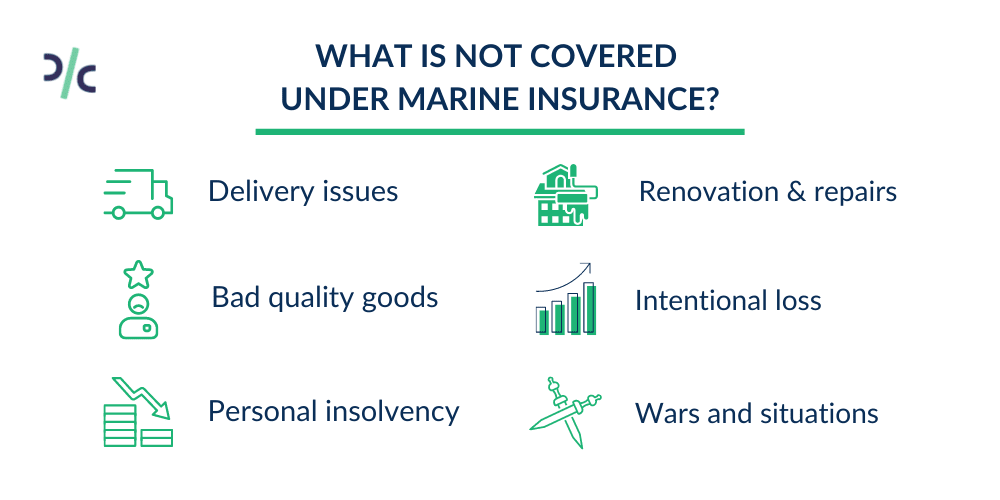

What is not covered under Marine Insurance?

Fire insurance is an insurance that covers the risk of fire. The subject matter is any physical asset or property. The moral responsibility is an important condition here. There is no expected profit margin in terms of fire insurance. The insurable interest must be present before taking the policy and also at the time of loss.

Whereas, the Functions of Marine insurance is one that encompasses risks associated with the sea. The subject matter is the ship, freight or cargo. It does not consist of any clause related to the moral responsibility of the cargo owner or the ship. 10 to 15% profit margin is expected in terms of marine insurance. Also in marine insurance the insurable interest must be only at the time of loss.

- How International Ocean Freight Shipping Works?

- Shipper's Letter of Instruction | Meaning, Format & more

- FCL and LCL | Meaning & Difference

- Procedure & Charges for LCL Shipments

- Demurrage - Meaning & Charges in Shipping

- How CBM is calculated in Shipping?

- 24 Types of Containers used in International Shipping

Avani Ghangurde

Senior associate, public relations at drip capital.

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used in accordance with and for the purposes set out in our Privacy Policy and acknowledge that your have read, understood and consented to all terms and conditions therein.

Connect with us!

Get started today

Yacht Insurance

Let gallagher charter lakes navigate the insurance process for you..

Yachts are valuable assets worthy of the best insurance protection. And while yachts differ by construction, size and value they also differ in the way they are used and how they are navigated. Understanding the risks inherent with yacht ownership is critically important to being able to properly insure the yacht. That is why working with a Yacht Insurance Specialist is so important to procure the broadest protection available at the most affordable price. That is the definition of true value and that is what we are passionate about here at Charter Lakes. Our account executives will help you design a policy that precisely fits your needs. We have 24/7 claims service, so you will have support available when you need it in the unfortunate event that you have a mishap on the water.

Please note: Every yacht insurance policy is written differently and can vary greatly in the amount of coverage it provides. Charter Lakes represents the largest, most financially sound yacht insurance underwriters in the country. We understand the strengths and weaknesses of each underwriter’s policy form, including those of our competitors. Our Account Executives will help you find the right policy to precisely fit your needs and your budget.

Basic Yacht Policy Features Include:

- All Risk policy form written on an occurrence basis

- Physical Damage is written on an Agreed Value basis

- Protection and Indemnity Liability

- Pollution Liability

- Medical Payments

- Personal Property Coverage

- Uninsured Boaters Liability

- Towing and Emergency Assistance

Did you know that many yacht insurance policies specifically exclude loss caused by mechanical breakdown? That may not be surprising to you since your automobile policy excludes mechanical breakdown as well. However, we sell several policies that do not exclude mechanical breakdown loss. This could mean the difference between having a $ 50,000 engine failure covered or not.

The yacht Insurance marketplace can be challenging. Working with a Yacht Insurance Specialist is the best way to procure the broadest insurance protection at the most affordable price.

Putting our team behind you is a winning combination.

- Marketplace

- Drivers Club

- Entertainment

- Experiences

Yacht insurance

Designed for yachts over 26ft in length, our partnership with Markel means you’ll ride the waves worry free with coverage that fits the unique needs of a larger yacht.

From towing expenses to consequential damage you can rest assured you’ll be covered for the unexpected.

Let’s fix or replace it right

Hull coverage protection includes broad navigation limits, ice and freezing coverage and more. Protect and recover pays reasonable costs incurred when trying to protect your yacht from further damage.

Get what it’s really worth

We’ll work with you to set an agreed value on your yacht. That’s the amount you’ll be paid should the cost of repairs to fix your boat equal the value of your boat.*

Be prepared for bad weather

If there is a named storm, watch or warning the program will share some of the costs of protecting your yacht.

When you need a boat tow

Coverage for towing expenses if your yacht happens to get stuck in or out of the water, including the delivery of gas, oil, and parts.

Yacht in the shop? Get rental reimbursement

Receive up to $1,000 in rental reimbursement coverage if the insured yacht is damaged by a covered cause of loss.

Have a boat under 26ft in length? Check out the Boat program.

Having your yacht properly covered is just the beginning.

Coverage through Hagerty goes even deeper and protects you with help for medical payments and more.

Watercraft liability

Protection and indemnity if you are responsible for injuries to another person, or damage to their boat or their property.

Pollution liability

This helps to cover reasonable cost and expenses and includes damage to property or cleanup resulting from unintentional spillage of a contaminant.

Medical payments

You’ll get help with necessary medical expenses resulting from an accident causing bodily injury to any person while in, upon boarding, or leaving your insured boat.

Paid crew (Jones Act)

Coverage for legal obligations you have to those that run and maintain your yacht.

Optional yacht insurance coverages

If you enjoy activities like fishing while using your yacht, we can customize coverage to fit your lifestyle including fishing equipment protection, trip coverage, boat house, lift and trailer coverage and much more.

Have questions? We are here to help.

*Less any salvage value if vessel is retained by you after a loss. Agreed Value includes all taxes and fees unless prohibited by state law.

This is a general description of coverage. Additional terms, conditions and exclusions apply to all coverages. Insurance and discounts are subject to availability and qualifications and may not be available in all states.

Policies underwritten by Essentia Insurance Company or Markel American Insurance Company. Insurance services administered by Hagerty Classic Marine Insurance Agency, LLC.

Hagerty is a registered trademark of the Hagerty Group LLC, © 2024 The Hagerty Group, LLC. All Rights Reserved.

Hagerty Classic Marine Insurance Agency, LLC and The Hagerty Group, LLC are wholly owned subsidiaries of Hagerty, Inc. Please refer to publicly filed documents with the Security Exchange Commission, which can also be found at https://investor.hagerty.com/overview

Table of Contents

Yacht insurance.

Yacht insurance is a specialized type of insurance policy designed to protect yacht owners from potential financial losses associated with their vessel. It typically covers damages to the yacht caused by accidents, theft, or natural disasters, as well as liability coverage for injuries or property damage to third parties. Additional options may be included for coverage of personal belongings, emergency assistance, and towing.

The phonetics of the keyword “Yacht Insurance” is: ˈjɑt ɪnˈʃʊrəns

Key Takeaways

- Yacht insurance provides coverage for various risks associated with owning and operating a yacht, such as accidents, theft, and damage caused by natural disasters.

- Insurance policies can be tailored to fit the unique needs of each yacht owner, with options for additional coverage like personal belongings, liability, and towing assistance.

- It is essential to research and compare insurance providers, coverage options, and premiums to ensure you’re getting the best yacht insurance policy for your specific needs and budget.

Yacht insurance is important in the business and finance realm because it provides comprehensive coverage to yacht owners for potential damages or losses related to their valuable marine asset. Due to the high cost of yachts and the potential risks associated with water-based activities, such as accidents, theft, or natural disasters, yacht insurance serves as a crucial financial safety net. Not only does it safeguard the substantial investment made by the owner, but it also offers liability protection, ensuring a more secure boating experience. Additionally, yacht insurance helps maintain the overall stability of the maritime industry, as it encourages responsible yacht ownership and management, ultimately contributing to a healthy and prosperous sector.

Explanation

Yacht insurance is designed to provide protection and assurance to yacht owners against various unexpected events that can occur while owning or using a luxury vessel. The purpose of obtaining yacht insurance is to safeguard yacht owners from potential financial loss due to unforeseen damages, liability issues, or accidents. As yachts are high-value assets, owners invest in insurance policies to protect their investments and ensure their peace of mind while enjoying their time out at sea.

Yacht insurance is commonly used to cover a variety of potential risks associated with owning and operating a yacht. These may include physical damages to the yacht itself caused by events like fire, theft, sinking, collisions, or weather-related incidents. Additionally, yacht insurance often encompasses liability coverage, which protects the owner against claims from third parties for incidents like personal injury or property damage that may occur due to the operation or ownership of the yacht. Some policies may also offer extended coverage for situations such as personal effects replacement, emergency towing expenses, and crew member welfare.

Ultimately, yacht insurance is a valuable tool for yacht owners to mitigate risks associated with their prized possession and foster a sense of financial security when they take to the open waters.

Example 1: A privately-owned luxury yacht: In this real-world example, a successful entrepreneur owns a high-value 100-foot luxury yacht which is used for hosting exclusive events and private vacations with friends and family. To protect their substantial investment, the yacht owner consults with an insurance broker specializing in marine insurance and obtains a yacht insurance policy. This policy would typically cover potential damages and loss due to accidents, theft, weather-related incidents, or liability in case of injury to guests or crew while onboard.

Example 2: A yacht charter business: A yacht charter business provides fleets of yachts for customers to rent for various events, holidays, or sailing adventures. The company’s livelihood depends on keeping their yachts available, safe, and well-maintained, so they purchase yacht insurance policies for each vessel in their fleet. These policies may include hull and machinery coverage, protection and indemnity (P&I) coverage, and business interruption insurance. By having yacht insurance, the company ensures they can continue operating and generating revenue, even in the event of damage, loss, or other unforeseen incidents involving the yachts.

Example 3: A member of a yacht club: An individual who is a member of a yacht club owns a vessel they regularly use for leisure or competitive sailing events. In this case, the yacht club may require members to carry yacht insurance as a condition of their membership. This is to protect the club, its members, and guests from any potential financial risks, especially from damages to club property or other members’ boats that might occur during club events or when using club facilities. By obtaining yacht insurance, the yacht owner can participate in the yacht club activities with peace of mind, knowing they have the necessary coverage in case of accidents, theft, or other damages.

Frequently Asked Questions(FAQ)

Yacht insurance is a specialized type of insurance policy that provides coverage to yacht owners to protect them against potential losses or damages to their yacht or boat, as well as liability for incidents occurring on or around their watercraft.

Yacht insurance is generally required by yacht and boat owners who want to protect their valuable investment and themselves against potential risks such as accidents or other unforeseen events, like theft, storms, or fires. It may also be a requirement by marinas or lenders if you have a loan or need to dock the yacht.

Yacht insurance usually includes multiple types of coverage, such as hull coverage (physical damage to the yacht itself), liability coverage (for injury or property damage caused by the yacht owner), personal property coverage (for personal belongings on the yacht), medical payments coverage (for injuries to the yacht’s occupants), and uninsured/underinsured boater coverage (protection against uninsured or underinsured boaters).

Yacht insurance typically covers larger and more luxurious watercraft, generally over 27 feet in length. Boats smaller than that may be covered under different types of marine insurance policies like boat insurance or personal watercraft insurance.

The cost of yacht insurance will depend on several factors, such as the yacht’s value, size, age, type, and location, as well as the coverage and deductible chosen. Yacht insurance typically costs more than boat insurance for smaller vessels.

Yes, there are several ways to potentially reduce the cost of your yacht insurance. These may include opting for a higher deductible, taking boating safety courses, choosing yacht insurance policies with limited coverage, or bundling your yacht insurance with other insurance policies like home or auto insurance.

When selecting a yacht insurance provider, consider factors such as the company’s financial stability, reputation, customer service, and claims handling process. Additionally, compare quotes from multiple providers and ensure that the coverage options meet your specific needs.

If you plan to take your yacht outside your home country’s waters, you should consider adding international coverage to your yacht insurance policy. This type of coverage usually protects you against risks and liabilities that may arise when navigating international waters.

Most yacht insurance policies will provide liability coverage for injuries or damages incurred by your guests while on board your yacht. However, for paid crew members, you might need to purchase additional coverage such as “crew coverage” or workers’ compensation insurance.

If you need to file a claim for your yacht, it’s essential to contact your insurance provider as soon as possible to report the incident. They will guide you through the claims process, which will usually require documentation, photos, or other relevant information about the event that led to the claim.

Related Finance Terms

- Marine liability coverage

- Hull and machinery insurance

- Personal property protection

- Emergency towing and assistance

- Crew welfare insurance

Sources for More Information

- Investopedia

Due makes it easier to retire on your terms. We give you a realistic view on exactly where you’re at financially so when you retire you know how much money you’ll get each month. Get started today.

Due Fact-Checking Standards and Processes

To ensure we’re putting out the highest content standards, we sought out the help of certified financial experts and accredited individuals to verify our advice. We also rely on them for the most up to date information and data to make sure our in-depth research has the facts right, for today… Not yesterday. Our financial expert review board allows our readers to not only trust the information they are reading but to act on it as well. Most of our authors are CFP (Certified Financial Planners) or CRPC (Chartered Retirement Planning Counselor) certified and all have college degrees. Learn more about annuities, retirement advice and take the correct steps towards financial freedom and knowing exactly where you stand today. Learn everything about our top-notch financial expert reviews below… Learn More

Log in to Markel

- US Broker Agent

US customer login

Log in to make a payment, view policy documents, download proof of insurance, change your communication and billing preferences, and more.